By Aaron Hector, B.Comm., R.F.P.

I’m going to start this off by saying that I’ve searched high and low for an article, website, blog – anything – that backs up some of the planning concepts I’m about to share with you on the subject of Old Age Security (OAS). I couldn’t find anything, so it’s with a certain degree of hesitancy that I find myself writing this. Even though I believe the concepts are factually correct, they’re largely unproven in practice.

I’ve come to realize that the majority of writing, thinking, and media coverage surrounding government pensions like OAS and CPP (QPP in Quebec) are targeted towards households in the middle-to-upper-middle-income or net-worth range, and the planning opportunities for high-income and high-net-worth households are often overlooked. With this article, I’m going to try and change that.

I’ll start with a bit of background information.

OAS deferral enhancement – choosing your start date

The introduction, in July 2013, of deferral premiums for Old Age Security has given Canadians and their financial planners a lot to think about. What was once a fairly standard ‘take it or leave it’ choice at age 65 has become a more complex decision. The complexity stems from the fact that for each month you delay the payment of your OAS past the age of 65, your lifetime monthly payment will be increased by 0.6%. This enhancement is maxed out at 36% if you postpone it to age 70. Don’t overlook the planning options available to you when choosing your start date. When you do the math, there are sixty potential start dates, and sixty potential payment amounts: one for each month between ages 65 and 70.

Choosing an effective start date – immediate vs. retroactive

Here’s another wrinkle. If you apply for OAS after age 65, you can choose a start date that’s up to one year earlier than the current date on your application. So, if you’re applying in January 2020, you could choose your OAS payments to begin as early as February 2019. All payments will be based on whatever age you were as of February 2019, and you’ll be paid a retroactive lump sum for the period between February 2019 and January 2020 (or whenever your application is approved and processed). Following the lump sum, you’ll get the regular ongoing monthly OAS payments, again, which will be based on your age as of February 2019.

Another important fact is that the retroactive lump sum payment is included on your T4A (OAS) slip in the year that it’s received. So, if you apply for a retroactive start date that reaches back to a prior calendar year, it will still be income for the current year when received. This is important because it lets you shift your initial OAS income from a less desirable tax year to a more desirable tax year. This would be of value if you retired in one year (while in a high marginal tax bracket), and shifted your OAS for the first year into the following year when you’re fully retired and in a lower tax bracket.

Understanding the clawback

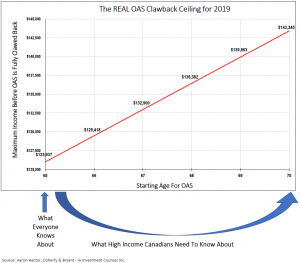

It makes sense that most people would dismiss OAS planning for high-income and high-net-worth Canadians. After all, OAS is famously clawed back by 15 cents for each dollar that your net income exceeds a certain annual threshold and is entirely clawed back when it reaches another. The stated clawback range on the Government of Canada’s website for 2019 income is $77,580 to $125,937. I refer to these limits as the clawback floor ($77,580) and the clawback ceiling ($125,937). For a Canadian whose income is expected to always exceed $125,937, one might conclude that there’s nothing that can be done to preserve any OAS. That would be an incorrect conclusion.

OAS secret number 1 – the clawback ceiling is NOT $125,937 for everyone

Let’s review the math of OAS clawback. OAS is eroded at a rate of 15 cents for each dollar your net income exceeds the clawback floor in any given tax year. If you started your OAS at age 65, then in 2019 you would expect to receive OAS payments which total $7,253.50 (assuming OAS is not indexed in the fourth quarter of 2019, which is yet to be confirmed). The clawback ceiling is $125,937 because with a clawback floor of $77,580 and an erosion rate of 15 cents per dollar, your $7,253.50 of OAS is fully eliminated by the time your income reaches $125,937 ($125,937 minus $77,580 = $48,357, and $48,357 x 0.15 = $7,253).

I get frustrated when I see a reference to the OAS clawback ceiling because every article or resource that I’ve seen completely ignores the deferral enhancement. Due to the method with which the OAS Recovery Tax or clawback is calculated, a more robust OAS pension will result in a higher OAS clawback ceiling. So, while the clawback floor is a fixed number which is set each year by the CRA, the clawback ceiling is not a fixed number. Rather, it’s a sliding number based on the amount of OAS that you actually receive. Sure, if you take OAS at age 65 (like most people), your clawback ceiling for 2019 is going to be the stated $125,937. But if you’re receiving higher payments due to postponing your start date, you’ll have a higher clawback ceiling. For example, if you delay your OAS to age 67, you’ll actually have a ceiling of nearly $133,000, and if you delay your OAS to age 70, your clawback ceiling will exceed $143,000.

This enhanced clawback ceiling provides opportunities for some very interesting planning. Retirees who don’t expect to keep any of their OAS because they forecast that their retirement income will be in the $125,000 range might need to reconsider and potentially wait to start their OAS until 70. For others, it may be best to take OAS at age 65 because when their RRSP is converted to a RRIF, their income will exceed even the $143,000 range. Perhaps an early RRSP melt-down strategy combined with OAS postponement to age 70 will achieve the best result.

Ultimately, the right decision will depend on various individual metrics, such as your projected income in the years between ages 65 and 70, and into the future. The size of your RRSP and eventual RRIF will also be a factor, as well as your health and expected longevity (and that of your spouse, if applicable). There are truly too many factors to determine the best course for the broad population; my point here is simply that the enhanced clawback ceiling should be one factor to consider within the mix.

As an aside, the clawback ceiling is similarly lowered for those who do not qualify for a full OAS pension. This would be the case for those who have not met the full residency requirements. For example, someone who only receives half of the full OAS pension for 2019 ($3,627) will have their OAS fully clawed back when their income reaches $101,758.

OAS secret number 2 – how to create an OAS “super-ceiling”

Now that we’re all experts on OAS clawback, and we acknowledge that the OAS ceiling is not a fixed number but actually a range, we can consider some further niche planning opportunities.

For example, is there any way for someone with an expected retirement income of $150,000 per year to ever take advantage of OAS? This level of income exceeds the $143,000 upper ceiling range for someone who starts their OAS at age 70. The answer is yes.

You could combine a retroactive lump sum application with a deferral to create a “super-ceiling” for one year. To do this, you would defer your OAS to a date beyond age 70 and, in doing so, you’d be eligible to receive annual OAS payments in the amount of $9,865 (36% more than $7,253). However, at the same time you would request a retroactive lump sum payment that would pre-date the application date by one year. If you timed the application right at the beginning of the year, you could effectively receive two years of 36% enhanced payments – or $19,730 – in a single calendar (and tax) year.

With OAS income of $19,730 in a single calendar year, you would have a potential clawback ceiling of $209,110 for that year. Even with an income of $150,000, you’d have the opportunity to keep a one-time amount of $8,866 from the OAS program. Perhaps not a significant amount for a well-off individual, but it’s a lot better than the $0 you’d get without structuring your OAS application to create a clawback super-ceiling.

OAS secret number 3 – even the wealthiest can capture a single year of OAS

Warning: this one gets weird.

Let’s review the opportunities for someone with an annual income of $250,000 or higher. Is there anything that can be done to squeeze any marginal benefit out of the OAS program? Hint: it’s a trick question.

$250,000 exceeds even our clawback super-ceiling mentioned above and so, unfortunately, nothing can be done to preserve any OAS during your lifetime. However, while you’d be out of luck, your heirs would not be thanks to a little-known provision in the OAS Act.

An executor is authorized to submit an application to begin OAS on behalf of someone who is deceased, as long as the deceased never applied on their own and the executor submits the application within one year of the date of death. OAS benefits always cease upon death, so the opportunity here relates to the ability to reach back and obtain a lump sum payment for the one year prior to the date of death. The OAS income would be paid after death, and as such could be included on an optional tax filing called a return for rights or things. The income on a right or things return is generally quite minimal and, accordingly, it’s unlikely that this OAS would be clawed back. The beneficiaries would split the OAS income for that one year, which could be nearly $10,000 if the deceased was over 70. I’ve written about this concept in additional detail in another post which I encourage you to read for further information on this idea.

Conclusion

Though it could be argued that the OAS program is not designed to support wealthy Canadians, I believe that you should be allowed to make decisions about your finances with all possible options in front of you. What you decide to do is up to you.

Some of the ideas explored here may seem a bit outside the box, and I admit that they’ve not yet been proven in widespread practice. However, the OAS and income tax rules stated here do have merit and practical applications. If you choose to implement these ideas as part of your financial plan, please do reach out to me to let me know how it plays out.

To learn more about OAS clawback, I invite you to explore this article by Doug Runchey, who I consider to be one of Canada’s leading experts on both OAS and CPP.

Aaron Hector, B.COMM., CFP, R.F.P., TEP, is Vice President & Financial Consultant at Doherty & Bryant Financial Strategists. Aaron is often sought out as an expert in the media, having been quoted frequently within The Globe and Mail, Financial Post, MoneySense, and Motley Fool. He also writes personal finance articles which can be found within T.E.’s quarterly newsletter, “Strategies” and also online within T.E.’s blog website.